What is the problem?

Although challenging, a quantitative approach to cyber risks has proven more effective in cyber security management. It gives the necessary value information inherent to each risk, allowing companies to make educated decisions for their cyber investments, risk exposure monitoring, and insights on the return of investment in their security portfolio. According to The Future of Cyber survey (Deloitte, 2019)[3], 50% of the participating C-level executives use quantitative risk tools, and the other half rely on the experience of their cyber leadership or cyber maturity assessments.

Quantifying the financial impact of a risk event allows organisations to confidently address questions such as "How much should we invest in cybersecurity?", "What will be the return on investment?" and "Do we have enough cyber insurance coverage?" [4]. Given that cyber risk may not even be insurable in the future [5], companies need to financially comprehend and quantify their exposure to cyber risk to define the best risk management strategy.

To determine the efficacy of the risk management process, organisations must enhance their current risk management techniques by incorporating cyber risk quantification to calculate the necessary security investments and estimate the resulting risk reduction [6].

The key problems we have identified are:

- Weak communication is the main barrier between business leaders and the cybersecurity function [7].

- Companies need help measuring and monitoring cyber risk [8].

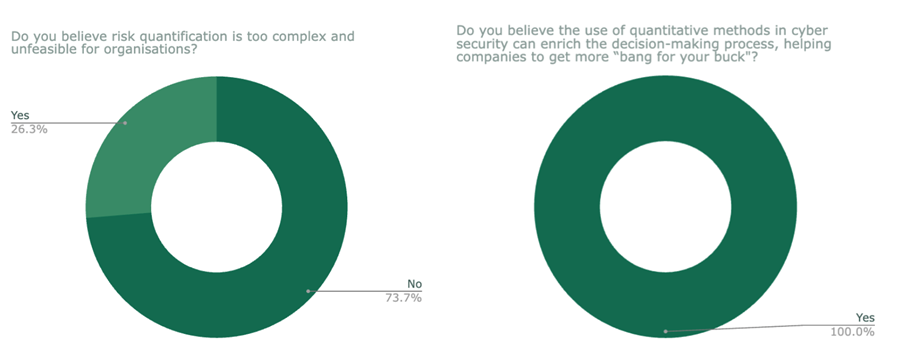

- Risk quantification in cybersecurity is relatively new compared to other industries, such as Insurance and Finance [9].

- For many organisations, risk quantification models and techniques are an esoteric topic [10].

This brings us to the problem we have examined: The lack of clear guidance, measurement and effectiveness of cyber risk quantification leads to low adoption of risk quantification by managers, and it remains a black box and esoteric topic for non-subject matter experts.