A Market at an Inflection Point

The cyber insurance industry is at a defining moment. Once viewed as a reactive financial hedge against cyberattacks, insurance is now evolving into a proactive mechanism for managing cyber risk and rewarding verifiable resilience. Two converging forces are driving this transformation:

- The maturing of Zero Trust security principles as a measurable risk-control framework, and

- Academic research linking insurance requirements to standardized cybersecurity controls exposes a critical need for alignment between insurers and the insured.

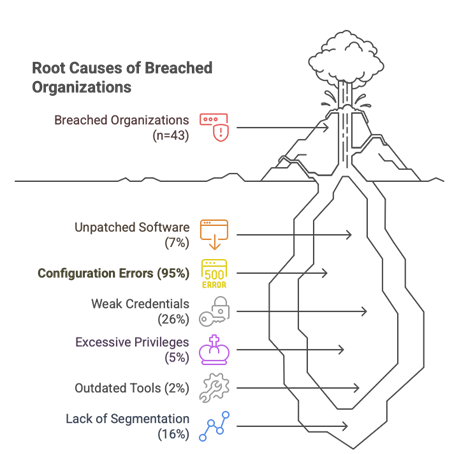

Recent academic work at Antwerp Management School (AMS), Mapping Cyber Insurance Questionnaires to Standardized Security Controls, provides the most granular view yet of how cyber insurers assess risk. The study, led by Steve Bielen (Senior Information Security Officer) under my supervision, systematically mapped 12 underwriting questionnaires from major European insurers against the CIS Critical Security Controls. The findings are a wake-up call for both underwriters and CISOs: the alignment between what insurers ask and what actually reduces cyber risk remains partial, inconsistent, and often superficial.